A Guide to Offset Mortgages

Offset mortgages can be a great way to manage your savings while reducing the cost of your mortgage, but there are a few things to keep in mind before you decide if this is the right option for you.

Offset Mortgages can help you pay off your mortgage faster or even reduce your monthly payments.

What is an Offset Mortgage?

An Offset Mortgage uses any savings that you have to ‘offset’ the interest charged on the mortgage balance. This has the effect of reducing the mortgage interest payable to the lender and so makes your mortgage a little cheaper.

How do they work?

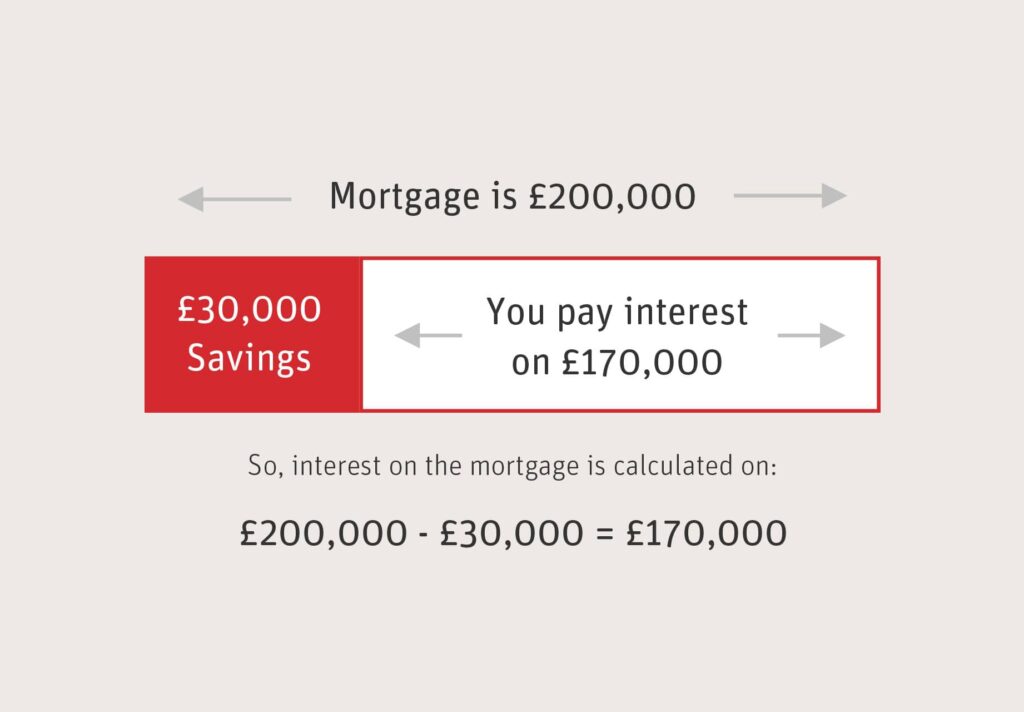

They work by looking at the combined balances in your mortgage account and your linked accounts each day. The savings amount is deducted from the mortgage amount, leaving a lower figure. This net amount is then used to determine the amount of interest due for that day.

While you won’t earn any interest on the savings account, you won’t be charged any interest on the same amount of money in your mortgage.

You will normally be able to link more than one account to the mortgage. This could allow you to have a current account and a savings account, with their combined balances being used to offset the interest charged.

How are my mortgage and savings combined?

Any money you deposit remains in separate accounts, so you always have instant access to your savings. However, they are linked by the lender which means you only have to pay interest on the difference between the amount in your savings and the outstanding mortgage.

The more you save, the less interest you’ll pay on your mortgage

Instead of earning interest, your savings are used to reduce the amount of interest you pay on your mortgage. This has the added benefit of causing the interest ‘earned’ from your savings to effectively be tax free as you don’t physically receive it.

So if you have an offset mortgage for £200,000 and £30,000 as linked savings you will only pay interest on the difference, £170,000.

CONTACT A MORTGAGE BROKER

If you are ready to take the next step then we can put you in touch with a fully qualified independent mortgage broker.

What is the difference between an offset mortgage and a normal mortgage?

The biggest difference between an offset mortgage and a standard mortgage is that with an offset mortgage, you open up a separate savings account that is linked to your mortgage account. Any money that you deposit into the offset account will reduce the amount of interest that you pay on your mortgage. This can be a great way to utilise any spare cash.

I don’t have a lot of savings, is it worth it for me?

An Offset Mortgage only works for people that have spare cash or savings that they are happy to leave in the linked account to reduce the mortgage interest charged. There will be a minimum level of savings needed to make this worthwhile for you (the lender won’t mind at all).

Discuss this with your mortgage broker to see what the benefits could be compared to a standard mortgage deal.

Current Account Mortgages (CAMs)

Current account mortgages are a form of offset mortgage but are not as widely available.

Like a normal offset arrangement they allow you to reduce the mortgage interest charged by offsetting your linked savings. Certain lenders allow you to include loans and credit cards so that they can also benefit.

The downside for many people is that the scheme only utilises a current account, where the balance shown is always negative.

It is still your debts less your savings but expressed as one figure. This makes it that bit harder to be certain how much you have in savings or in the current account as they are not segregated.

Consequently they are not a popular choice.

The pros and cons of offset mortgages

PROS

Can lower your interest costs

Can reduce your mortgage term

Can lower your monthly payments

Provides a tax efficient return

Easy access to savings

CONS

Need to have sufficient savings

Interest rates not always competitive

No paid interest on savings part

How do I know if an offset mortgage is right for me?

The best way to determine if an offset mortgage is right for you is to speak with an independent mortgage adviser. They will be able to review your financial situation and help you decide if this type of mortgage is a good option for you. You should also compare the different options that are available to you and make sure that you understand the terms and conditions of each one before making a decision

What is a family offset mortgage?

A family offset mortgage is a type of offset mortgage that allows you to link multiple deposit accounts to your mortgage. Most commonly used where a parent wants to assist their children with mortgage repayments.

The child will take out the mortgage to purchase a property. The parent/s can then deposit savings into one of the linked accounts, effectively reducing the amount outstanding.

Crucially the deposited funds still belong to the parent/s.

The more money that you have in the offset accounts, the less interest you will pay on your mortgage.

Can self-employed people get an offset mortgage?

Yes, they are available to any borrower who can provide sufficient proof of their income. This will include the self-employed, freelancers, contractors etc.

SOME UNIQUE FEATURES OF AN OFFSET MORTGAGE

Term Reduction

With this option the offset savings are used to pay off the mortgage earlier, rather than reduce the monthly payments.

The interest saved by offsetting the savings means more is paid back each month, and the mortgage should be paid off sooner.

Payment Reduction

With this option the offset savings are used to lower the monthly payments.

The interest saved each month will be used to reduce the amount of next month’s mortgage payment, so a greater offset will mean lower monthly payments.

Tax Free

Unlike a regular savings account there is no tax to pay on the money held within the offset deposit accounts.

This is because the interest earned from the savings element is used to offset the mortgage and not paid to the account holder.

How to get an offset mortgage?

There aren’t that many lenders who offer offset mortgages compared to those that offer standard mortgages.

The application process and the documents needed will be the same as any normal mortgage. But it is important to choose a mortgage that suits your needs. Not everyone would benefit from an offset or current account mortgage.

The best way to get the right deal is by speaking with a whole of market mortgage broker. They can look at what you need from a mortgage and then find the best solution from the thousands of products on offer.

We work with an independent mortgage broker who can provide expert advice for offset mortgages. Click here to contact a broker.

FAQ

Frequently Asked Questions

Can you have 2 offset accounts?

Yes. Most lenders allow you to have up to 4 or 5 accounts.

What is the equivalent savings rate?

In effect, the money in your savings account will achieve the equivalent rate that you are being charged on your mortgage.

Can I access my savings?

Yes. The savings accounts will have instant access.

Are my savings protected?

Yes. Your savings would be covered by the Financial Services Compensation Scheme.

Can I offset 100% of my mortgage?

Yes. If your savings balance equals your mortgage balance your interest charges will stop.

What are the tax benefits?

As you don’t actually receive any interest on Offset savings balances, this means there is no tax liability.