How much does the average mortgage cost?

Explore the average repayments for a UK mortgage: Understand what homeowners across the country are paying and how property types and location can affect your mortgage outlay.

Continue reading for a clear, concise breakdown that could help you shape your home-buying journey.

If you’re thinking about buying a home or changing your current one, it’s helpful to know how much you might be paying each month on your mortgage.

Our guide offers a straightforward look at the average mortgage repayments in the UK, considering different types of homes and where they are. With this information, you can start planning your budget more effectively. Keep reading to get a clearer idea of what your mortgage could look like.

The average mortgage payment

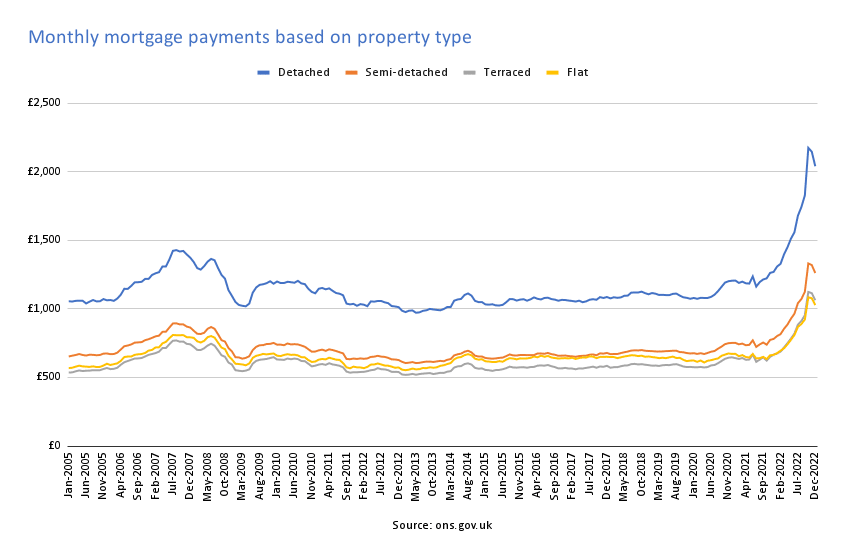

The average monthly mortgage payment in the UK is somewhere between £1028 and £2041 per month.

This difference in repayments is because the figures have been worked out on different property types. Larger detached properties will cost more than flats and so the mortgage, and the repayments, are larger.

You can use the table below to see how the payments change, depending on the type of property.

| Property Type | Average Repayment |

|---|---|

| Flat | £1028 pm |

| Terraced house | £1063 pm |

| Semi-detached house | £1262 pm |

| Detached house | £2041 pm |

This chart shows how the monthly payments have changed over the years

Source: UK House Price Index, Bank of England. Indicative monthly mortgage payments for average priced properties in the UK assuming average 5-year fixed mortgage (5.05%) over 25 years at a 75% loan-to-value. December 2022.

Regional differences

Where you live in the UK affects how much your mortgage repayments will be.

This is because house prices vary from region to region.

The table below shows the average monthly mortgage payments based on property type and location.

You can also see how these costs have changed over the previous 12 months.

Averaged monthly mortgage payments for flats.

| Region | December 2021 | December 2022 |

|---|---|---|

| London | £1287 | £1982 |

| South East | £651 | £1028 |

| East of England | £612 | £959 |

| Wales | £394 | £606 |

| South West | £559 | £865 |

| West Midlands Region | £417 | £664 |

| North West | £412 | £666 |

| East Midlands | £382 | £613 |

| Scotland | £372 | £553 |

| Yorkshire and The Humber | £387 | £620 |

| North East | £289 | £465 |

| Northern Ireland | £358 | £563 |

Source: UK House Price Index, Bank of England. Indicative monthly mortgage payments for average priced properties in the UK assuming average 5-year fixed mortgage (5.05%) over 25 years at a 75% loan-to-value. December 2022.

Averaged monthly mortgage payments for terraced houses.

| Region | December 2021 | December 2022 |

|---|---|---|

| London | £1686 | £2616 |

| South East | £941 | £1510 |

| East of England | £846 | £1345 |

| Wales | £477 | £767 |

| South West | £771 | £1229 |

| West Midlands Region | £557 | £896 |

| North West | £463 | £748 |

| East Midlands | £522 | £850 |

| Scotland | £454 | £703 |

| Yorkshire and The Humber | £463 | £747 |

| North East | £362 | £580 |

| Northern Ireland | £342 | £538 |

Source: UK House Price Index, Bank of England. Indicative monthly mortgage payments for average priced properties in the UK assuming average 5-year fixed mortgage over 25 years at a 75% loan-to-value. December 2022.

Averaged monthly mortgage payments for semi-detached houses.

| Region | December 2021 | December 2022 |

|---|---|---|

| London | £1990 | £3122 |

| South East | £1201 | £1941 |

| East of England | £1029 | £1656 |

| Wales | £590 | £951 |

| South West | £939 | £1512 |

| West Midlands Region | £686 | £1114 |

| North West | £637 | £1045 |

| East Midlands | £636 | £1045 |

| Scotland | £568 | £886 |

| Yorkshire and The Humber | £581 | £950 |

| North East | £453 | £736 |

| Northern Ireland | £466 | £747 |

Source: UK House Price Index, Bank of England. Indicative monthly mortgage payments for average priced properties in the UK assuming average 5-year fixed mortgage over 25 years at a 75% loan-to-value. December 2022.

Averaged monthly mortgage payments for detached houses.

| Region | December 2021 | December 2022 |

|---|---|---|

| London | £3145 | £4903 |

| South East | £1978 | £3156 |

| East of England | £1552 | £2491 |

| Wales | £934 | £1503 |

| South West | £1466 | £2305 |

| West Midlands Region | £1169 | £1872 |

| North West | £1035 | £1702 |

| East Midlands | £1026 | £1671 |

| Scotland | £955 | £1511 |

| Yorkshire and The Humber | £954 | £1556 |

| North East | £756 | £1253 |

| Northern Ireland | £728 | £1185 |

Source: UK House Price Index, Bank of England. Indicative monthly mortgage payments for average priced properties in the UK assuming average 5-year fixed mortgage over 25 years at a 75% loan-to-value. December 2022.

What can you buy with an average mortgage?

So far we have concentrated on the average monthly repayments.

But what kind of property does this get you, and how big does the mortgage need to be?

In mid 2023 the average size of a new mortgage was £192,863.

This figure hovers around £195,000 to £205,000 or so.

At 75% loan to value, you could buy a property worth £257,150

At 85% loan to value, you could buy a property worth £226,900

At 95% loan to value, you could buy a property worth £203,000

Flat

The UK average repayment of £1028 per month is based on a mortgage of £174,750 and a purchase price of £233,000.

This equates to a loan to value LTV of 75%.

Terraced House

The UK average repayment of £1063 per month is based on a mortgage of £180,750 and a purchase price of £241,000.

This equates to a loan to value LTV of 75%.

Semi-detached House

The UK average repayment of £1262 per month is based on a mortgage of £214,500 and a purchase price of £286,000.

This equates to a loan to value LTV of 75%.

Detached House

The UK average repayment of £2041 per month is based on a mortgage of £347,250 and a purchase price of £463,000.

This equates to a loan to value LTV of 75%.

What does loan to value mean?

When you borrow money to buy a home, the loan is typically expressed as a percentage of the property’s value. This is known as the loan-to-value ratio (LTV). Lenders look at your LTV when deciding if they’ll accept your mortgage application – the lower, the better. For example, let’s say you’re buying a £400,000 property and you need a £380,000 mortgage. Your LTV ratio would be 95% (£400,000 divided by £380,000).

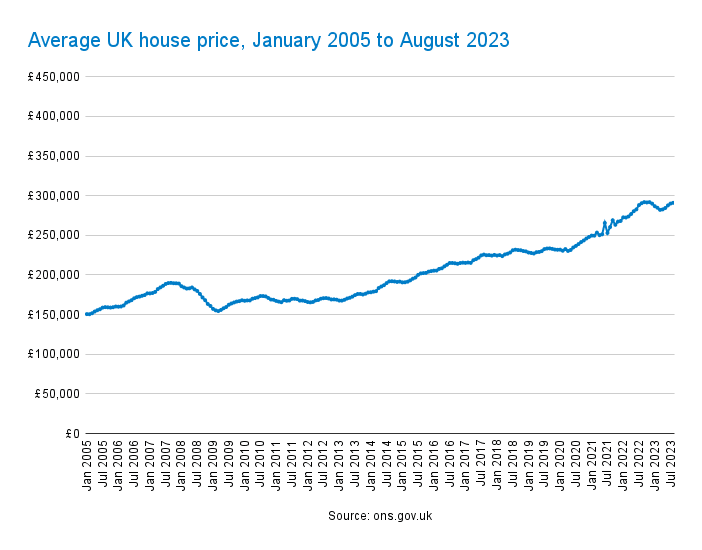

Average house prices

UK house prices have historically risen over the longer term. As the price of property goes up, there is a need to borrow more money when moving house. This then requires a higher monthly payment figure.

The chart below shows how UK house prices have changed since 2005.

What happens when interest rates change?

In the UK the vast majority (75%) of mortgages are taken with a fixed interest rate.

The duration of these will vary but most people pick either a 2 year deal or a 5 year deal.

And once you’re in a fixed rate your payments will be unaffected by external changes to interest rates (up or down).

The figures used above are taken from the Bank of England and various government departments. When you need to apply for a mortgage it is highly likely that the rates on offer will be different.

Let’s take a look at how changes in interest rates affect the monthly repayments.

| Property | Mortgage | Jan 2022 | Dec 2022 | June 2023 | Oct 2023 |

|---|---|---|---|---|---|

| 1.63% | 5.05% | 4.95% | 4.99% | ||

| Flat | £174,750 | £709 | £1028 | £1016 | £1020 |

| Terraced | £180,750 | £733 | £1063 | £1051 | £1055 |

| Semi-Detached | £214,500 | £871 | £1262 | £1247 | £1252 |

| Detached | £347,250 | £1410 | £2041 | £2019 | £2027 |

Source: Bank of England. Average monthly interest rate for 5 year fixed rate mortgage at 75% LTV.

CONTACT A MORTGAGE BROKER

If you are ready to take the next step then we can put you in touch with a fully qualified independent mortgage broker.

The average quoted mortgage rates for a five-year fixed mortgage at a 75% LTV

What affects the monthly cost?

The monthly cost of a mortgage will vary depending on the loan size, interest rate, repayment term and fees charged by the lender.

LOAN SIZE

The more you borrow, the higher the monthly repayments as there’s more to pay back. Your loan size is affected by your mortgage deposit. This can be from cash or cash+equity.

If you put extra cash in as a deposit then this lowers the mortgage and the repayments.

INTEREST RATE

The interest rate has a huge influence on the cost of a mortgage. Make sure you explore your loan to value and how this affects the rates you can choose from.

Lenders offer interest rates at certain maximum LTV; 60%, 75% etc.

If your mortgage works out at 76% LTV then it might pay you to find another 1% or so. Not only will your mortgage debt be a little bit lower but you can then access the 75% LTV deals, which we would expect to be cheaper.

REPAYMENT METHOD

Nearly all new mortgages are set up on a full repayment basis. So each month you are slowly chipping away at the balance.

Choosing an interest-only, or part and part option, will drastically reduce the mortgage payments. However, not all lenders allow these options and you are not actually repaying the loan at the same rate.

£250,000 mortgage over 25 years at 5%

| Full repayment | £1461 per month |

| Interest only | £1041 per month |

| Part & part (50/50) | £1252 per month |

MORTGAGE TERM

The default mortgage term for many borrowers has always been 25 years. Due to rising mortgage costs, and high property prices, we are seeing more borrowers choosing marathon mortgages which extend their mortgage term, to reduce the monthly cost.

Repaying a mortgage over 30 years or 35 years, instead of the usual 25 years, will make the monthly repayments more affordable.

£250,000 repayment mortgage at 5%

| 20 years | £1649 per month |

| 25 years | £1461 per month |

| 30 years | £1342 per month |

| 35 years | £1261 per month |

Some extra reading

Ready to get a clearer picture of your mortgage?

Check out our guides for detailed tips, use our calculators to see the numbers, and browse through extra information to help you understand everything better. These tools are designed to help everyone, whether you’re just starting out or are ready to move into a new home.

They’re here to make the mortgage process straightforward and easy to manage.

Final thoughts

Understanding average mortgage payments can be a helpful step for UK home-buyers in planning their budget and setting realistic goals for their property purchase. On average, monthly mortgage payments in the UK can range from £1,028 for a flat to £2,041 for a detached house, with variations depending on property type and regional price differences. These figures assume a typical 5-year fixed mortgage at 5.05% interest, over a 25-year term with a 75% loan-to-value (LTV) ratio.

The size of a mortgage will directly influence the monthly repayments, with a higher loan amount resulting in higher payments. Interest rates also play a critical role, and securing a lower LTV can offer access to more favourable rates. Nearly all mortgages are now set up on a full repayment basis, although the term can vary, with longer terms reducing monthly payments at the expense of increased interest over the life of the loan.

With over 10,000 mortgage products available from more than 100 lenders, it’s clear that options are plentiful, and finding the right one can be a pain-free process with the help of independent, award-winning mortgage advice.

Whether you’re a first-time buyer or moving home, getting acquainted with average mortgage payments, the influence of interest rates, and other cost factors will arm you with the knowledge needed to navigate the mortgage market. Remember, while these figures provide a guide, rates and repayments can vary, and speaking to a professional is always recommended for the best advice.

The figures and interest rates shown on this page have been sourced from the Bank of England and various government agencies. The very nature of historical data such as interest rates and property values is that it very quickly becomes outdated. We will update this page as new information becomes available. You should not rely on any of this information as the basis for choosing a particular mortgage or strategy. If in doubt, seek professional advice.